Standard costing was previously the go-to costing method for manufacturing, but there can be many other uses for standard costing both in manufacturing and in the other modules. You could say that standard costing can be used in companies delivering items that fluctuate in cost – not far of the description of companies using average costing.

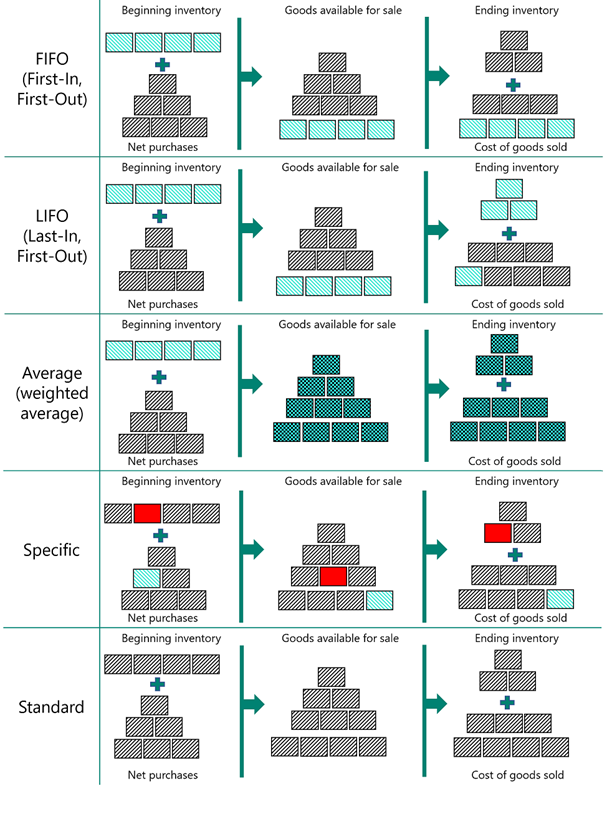

Microsoft Learn has this overview of the different costing methods:

However, the difference here is: Who pays for the fluctuating cost prices?

If FIFO or LIFO is being used, the sales people can be lucky or unlucky depending of the batch of items that were bought or produced, were they cheap or expensive?

Using Average costing method, the fluctuations in cost over a period are spread evenly over all items sold in the average cost period. This means that the sales people will not know the exact cost before the end of the average cost period.

Using standard costing, the price will be set politically, and no matter what price the items are replenished at, the standard cost will always be used. All deviations are posted to variance accounts and the sales people know their exact cost and thereby their profit.

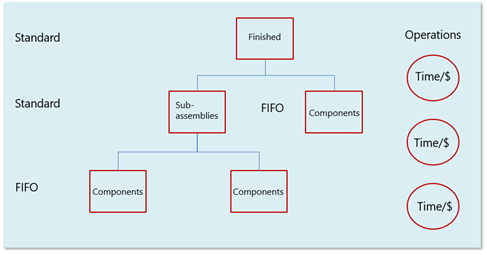

The standard costing method is often used in combination with other costing methods, especially when it comes to manufacturing. A typical setup of costing methods in manufacturing could look like this:

The reason for this is to avoid the fluctuating cost prices which would make the sales people pay for deviations in the productions. They will always have a stable cost for their profit calculations. On the lower levels, the deviation in component cost prices or time consumption in the production will be posted to special accounts as variances, more about that later.

The Microsoft Learn Best Practices section states when to use standard cost:

| Standard | Use where cost control is critical.Use in repetitive manufacturing, to value the costs of direct material, direct labor, and manufacturing overhead.Use where there is discipline and staff to maintain standards. | An item’s unit cost is preset based on estimated.When the actual cost is realized later, the standard cost must be adjusted to the actual cost through variance values. |

And this might be true, but it is not the whole truth. The Design Details also here gives a couple of warnings:

-

The Standard Cost Worksheet does NOT support standard cost per SKU

Meaning that it IS possible to have special prices on the SKU card, but it is not possible to maintain the prices through the Standard Cost Worksheet

-

No historic records exist for standard costs

Meaning that you can see the total deviation but not the individual adjustments

I would like to add a couple of warnings of my own:

- The standard cost does not necessarily reflect the actual price, the actual cost price is actually available in the report Inventory Valuation – Cost Specification

- Changing the standard cost on an item, it is an additional manual task to revaluate the standard cost of existing inventory

- The use of standard cost together with item charge does not make much sense because they will be directly posted to the variance accounts

Inventory Setup

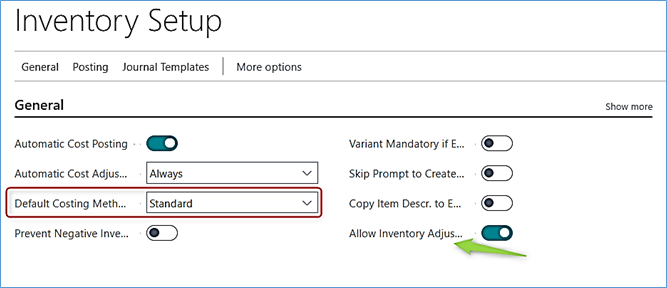

However, let’s start with setting the system up, and where better than to start in Inventory Setup.

The Default Costing Method only defines, which Costing Method should be suggested to every new item that is created. Except, of course, if a template is being used for creating items, which by the way is almost always

The Default Costing Method only defines, which Costing Method should be suggested to every new item that is created. Except, of course, if a template is being used for creating items, which by the way is almost always

It is possible to utilize different costing methods for different types of items, but new costing methods cannot be introduced during the fiscal year without advertising it in the yearly fiscal report and for listed companies even the relevant authorities.

Notice the green arrow which is a new field in BC23 to allow or disable manual adjustment directly from the item card. Thank you, Microsoft, we have been waiting for that.

Notice the green arrow which is a new field in BC23 to allow or disable manual adjustment directly from the item card. Thank you, Microsoft, we have been waiting for that.

Item Card

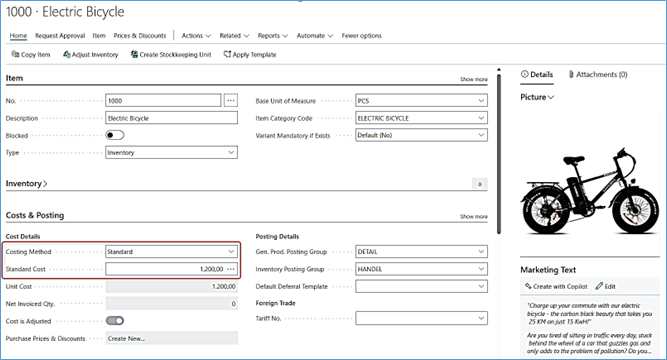

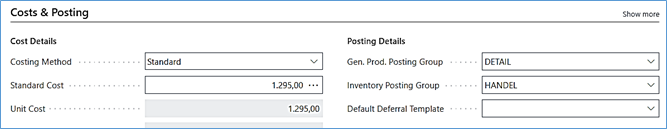

Next is of course the Item card:

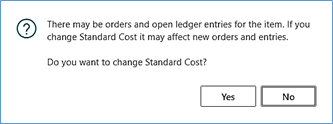

The Costing Method field is set with the politically set price. Changing the standard cost will give this warning:

This means that, if it is an existing item, you now have two choices:

- Change the standard cost for the item for future use. All existing documents and open item ledger entries will keep the old price.

- Change the standard cost for the item for future use. Then all open item ledger entries must manually be changed in the Revaluation Journal. All existing open purchase documents will be automatically be posted with the new unit cost.

Adjust Item Costs/Prices

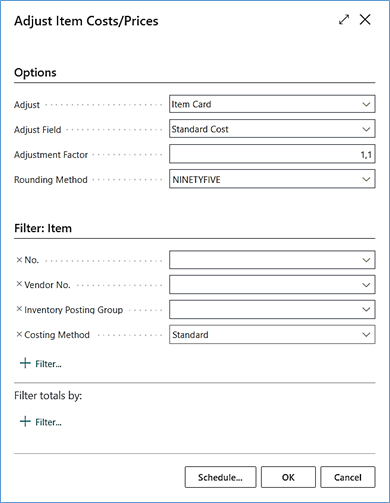

There is functionality to help maintaining standard cost prices on the Item card or the Stockkeeping Unit card in the Adjust Item Costs/Prices:

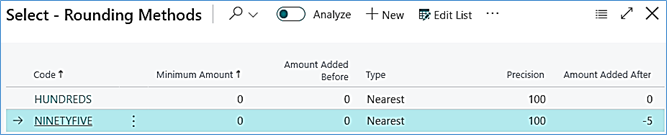

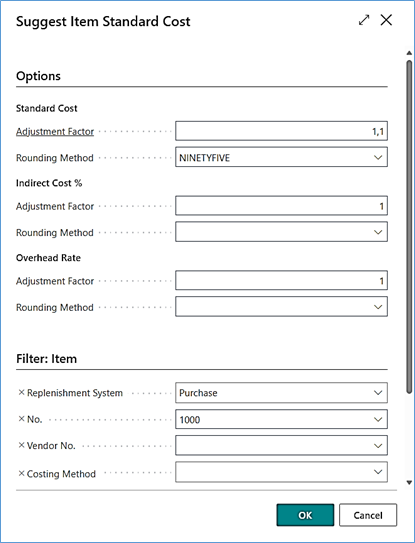

So, it is possible to run through all items with standard costs, raise the standard cost with 10% and round it to the nearest 95.

The rounding method look like this and the result would be 1295:

This functionality is a little bit risky because it does not warn about the existing open item ledger entries. Also, it does not give an overview over the changes that will be made, but most importantly, it is not possible to roll back.

Standard Cost Worksheet

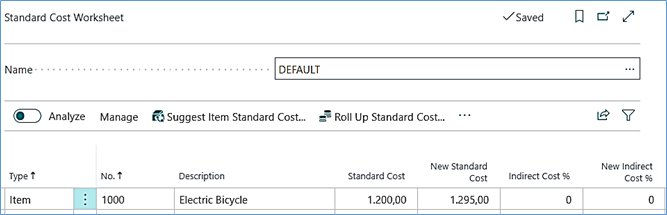

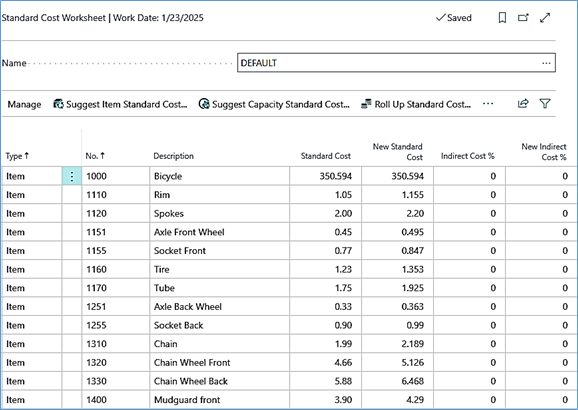

Therefore, instead the Standard Cost Worksheet is the preferred functionality for maintaining cost prices:

Here the functionality is the same and more than in the Adjust Costs/Prices batch. The only setback is that is does not support stockkeeping units. There is a BC Ideas suggestion for this here, just go and vote for it.

The result, is presented in the worksheet with the before and after prices:

Then it is possible to adjust the calculated prices before implementing them.

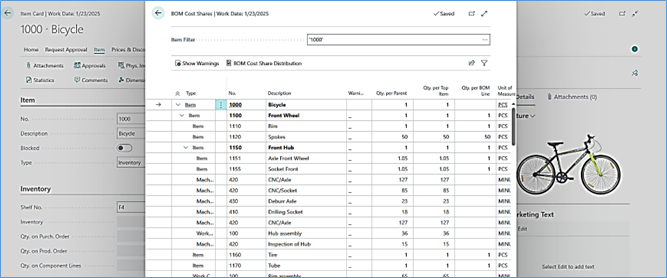

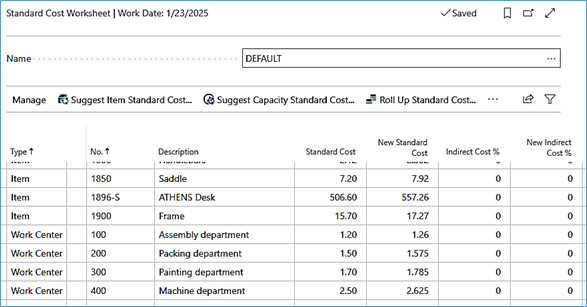

If the item is a manufactured item, then the Standard Cost Worksheet have some awesome functions. I have switched to another database with a produced item that look like this:

The Item is produced and consists of a BOM and a Routing.

When calculating the item, I run the Suggest Standard Cost function two times:

-

Once to pick up all the produced items using standard cost, I will keep the adjustment factor to 1

- Secondly to pick up components that are being used in the production. It makes no difference if the components are standard cost or other costing methods, they will be included anyway. I set the Adjustment factor to 1,1 to simulate a 10% increase.

This way all components are added with a simulated increased cost

- Lastly, I run the Suggest Capacity Standard Cost to pick up all capacities that are being used in the production. I run this with a 5% increase in the costs

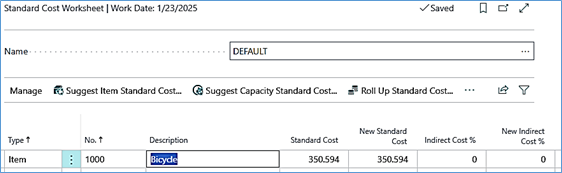

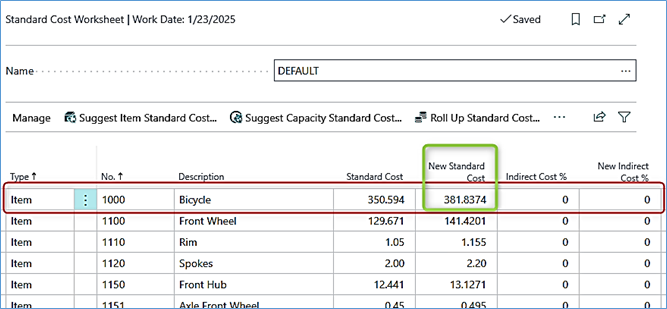

The reason for doing this is to simulate what the new standard cost would be for the produced items using the increased costs. And this can be done with the function: Roll Up Standard Cost:

All the rest of the items and capacities can now be deleted and the new price can be implemented:

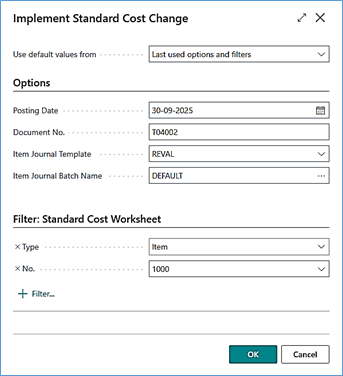

Here it is possible to add which Revaluation Journal that should be used for adjusting open entries. And again here, there are two options:

- Delete the revaluation journal and keep the prices only for future use

- Post the revaluation journal and adjust the existing entries as well

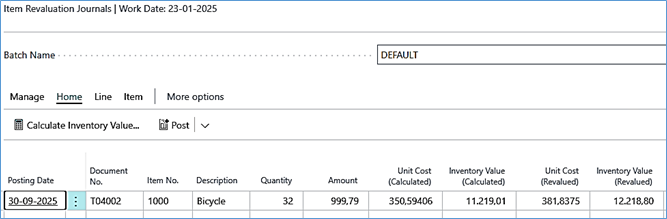

Here I do the latter:

So, now both the item card and the Item ledger entries have been updated to the new price.

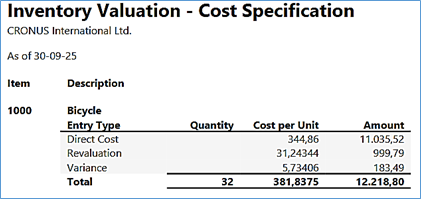

In order to document the revaluation, I use the Inventory Valuation – Cost Specification report:

Here, both the actual cost and the standard cost is explained wit both variance and revaluation.

Variance postings – purchase

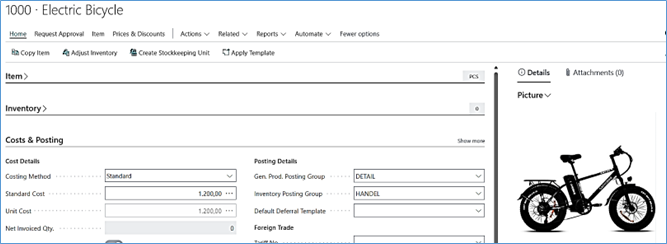

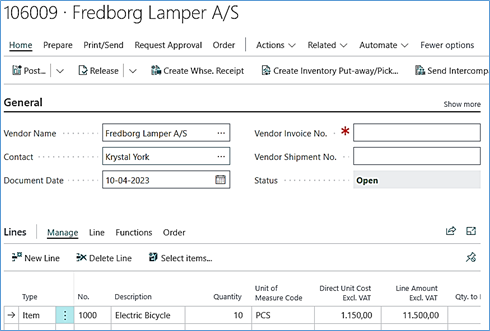

Variance postings depend on the replenishment system. In my electric bike example, the standard cost has now been set to 1200:

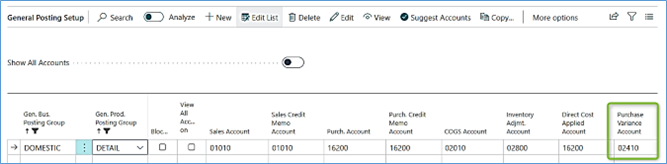

So, purchasing the electric bicycle at another price, the item will still be added to the inventory at 1200 but any variance will be posted to the purchase variance account from the General Posting Setup:

Therefore, if I purchase invoice posted with a Direct Unit Cost of 1150, it will cause a variance of 50 per item:

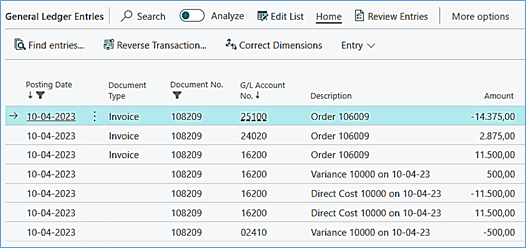

Giving these G/L entries:

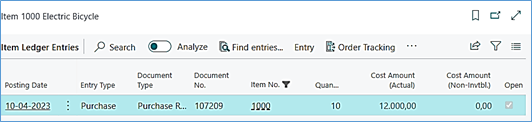

And these item ledger entries:

Variance postings – production

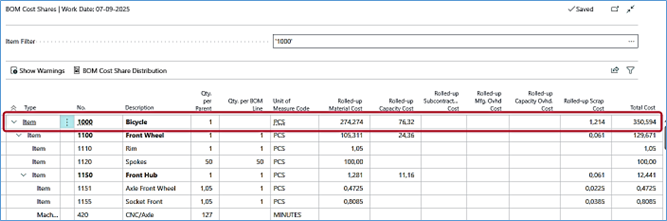

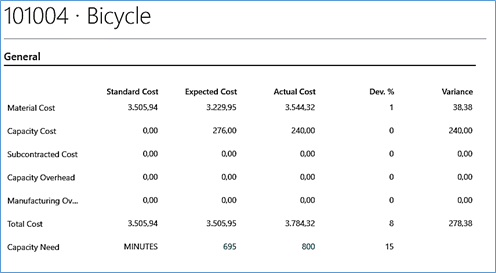

If the item had been produced, the item will still be produced at the standard cost, but the variance will be split up into categories. Here using the produced bicycle from previous that has a standard cost of 350,594 and the cost shares that look like this:

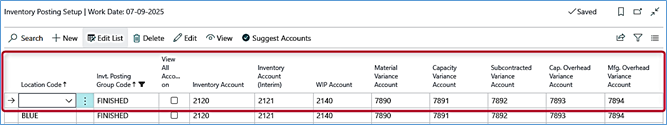

If a production order is made that deviate from the standard cost break down, the variance accounts from the Inventory Posting Groups will be used:

So, let me make a production order with way too many components and too little time spent:

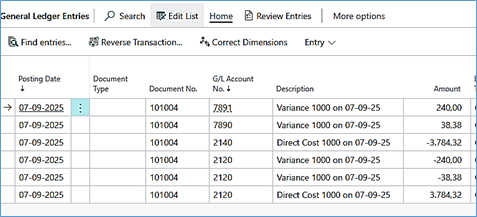

Here it is obvious that, there are deviances in the production. Changing the status to Finished, will post the variance to the different accounts:

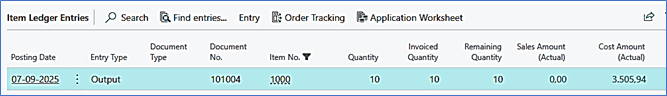

But the items produced are added to the inventory at the standard cost:

I hope this has clarified the use of standard cost a little bit.